Zero-Based Budget Spreadsheet Template in Excel and Google Sheets

Buy 2+ items → Extra 25% OFF on your total

⭐ JOIN & SAVE

Grab this template and 4 more with

SpreadsheetsHub Membership

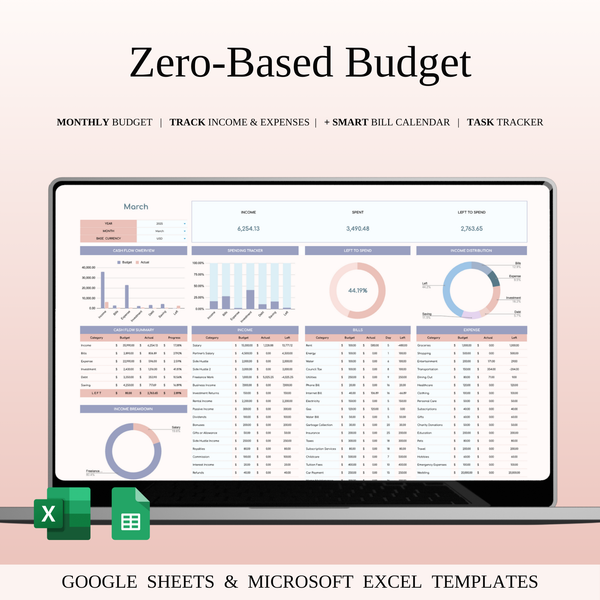

Take control of your money with the Zero-Based Budgeting method, which makes sure every dollar is assigned a purpose. This template helps you plan, track, and manage your spending effectively.

How to Use a Zero-Based Budget Spreadsheet | Step-by-Step Video Tutorial

What is Zero-Based Budgeting?

Zero-Based Budgeting is a budgeting method where every dollar is assigned a specific purpose before the month starts. Unlike traditional budgeting, where you may carry over balances from the previous month, Zero-Based Budgeting starts with a "zero balance." This means you allocate all your income to specific expenses, savings, or investments, ensuring that every cent is accounted for.

Who Is This Template For?

- Individuals looking for financial clarity: If you're someone who wants to track exactly where your money goes and align your spending with your financial goals, this template is perfect for you.

- Families and households: The Zero-Based Budgeting method is ideal for managing household expenses, ensuring that your income is carefully divided among necessary categories.

- Business owners and freelancers: This template can also be used to manage business-related finances by categorizing income and expenses efficiently.

Key Benefits of Using Zero-Based Budgeting:

-

Complete Financial Control

The Zero-Based Budget method helps you take full control over your finances by ensuring that every dollar is accounted for, whether it's for savings, paying off debt, or covering expenses. -

Improved Financial Awareness

With every category and expense reviewed from scratch each month, you gain a better understanding of your spending habits, which can lead to smarter decisions and better financial health. -

Debt Reduction

Since you are allocating every dollar, you can specifically assign funds toward paying off debt, speeding up the process and making your financial goals more achievable. -

Increased Savings and Investment Opportunities

By evaluating your income and expenses thoroughly, you'll have a clearer picture of where you can cut back and divert more funds toward savings and investments, giving your wealth-building efforts a boost.

Why You Need This Template:

-

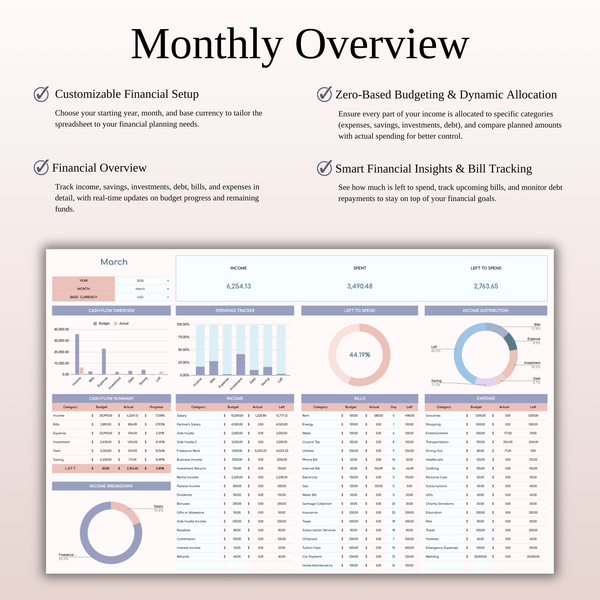

Customizable for Your Needs

Choose your starting year, month, and currency to tailor the template to your financial goals, whether you are working in dollars, euros, or any other currency. -

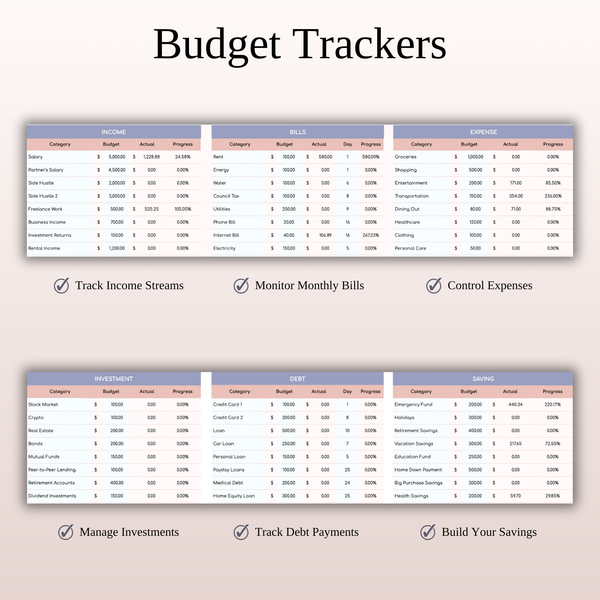

Clear Categorization

Organize your finances into customizable categories like income, bills, savings, expenses, investments, and debts to ensure precise tracking and management. -

Monthly Budget Planning

Allocate specific amounts to each category at the start of the month, helping you stick to your budget and avoid overspending. -

Automatic Tracking of Income and Expenses

The template helps you track all incoming and outgoing funds, automatically calculating totals to give you a snapshot of your current financial standing. -

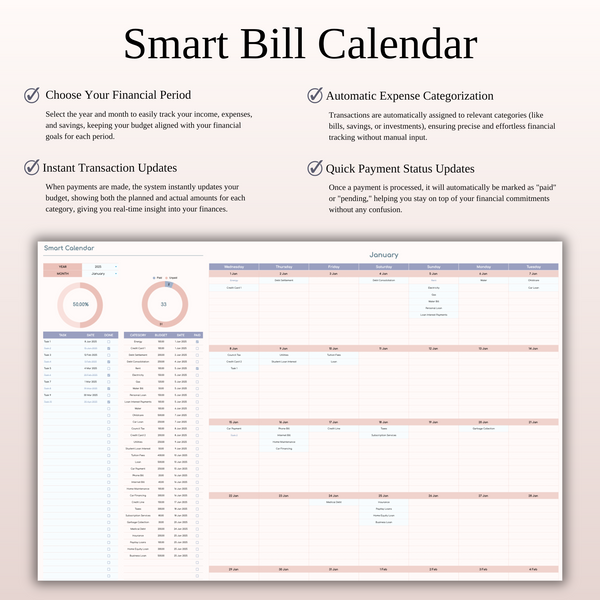

Smart Debt & Bill Management

Set reminders for bill payments and debt obligations to ensure you never miss a payment, and use the automatic tracking feature to mark completed tasks.

How It Works:

-

Set Your Budget

At the beginning of each month, input your total income and assign amounts to each category: bills, savings, debt repayment, expenses, and investments. -

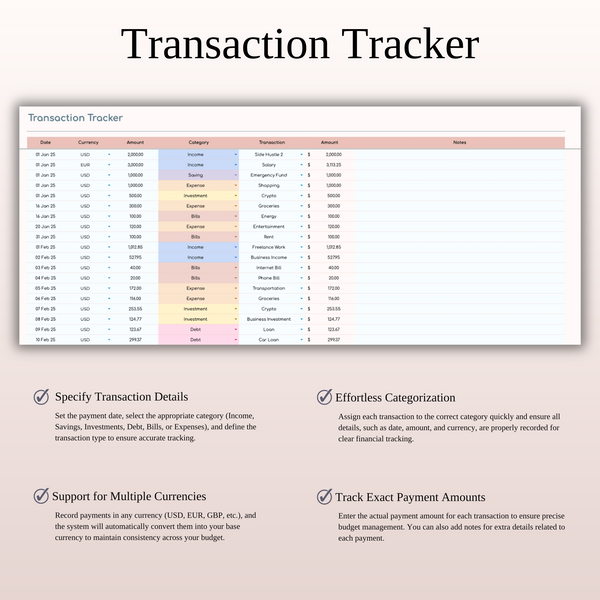

Track Your Spending

As you make payments or receive income, log the transactions into the template. The template will automatically update the balance in each category. -

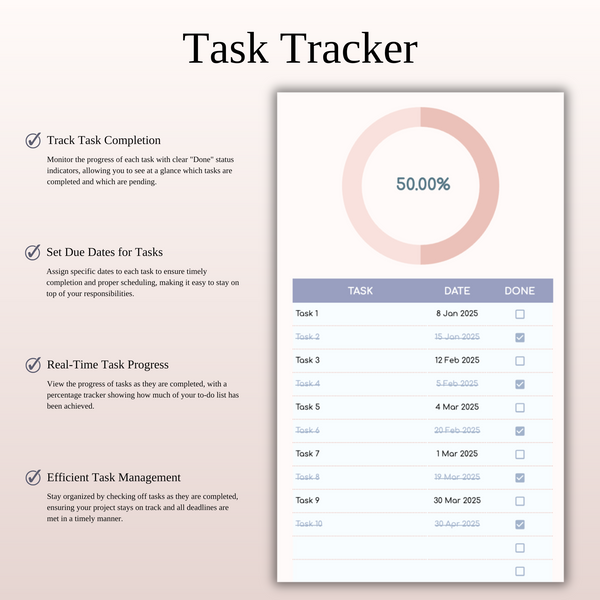

Stay on Target

With clear visual indicators and progress bars, you’ll always know how well you’re adhering to your budget and how much money is left to spend in each category.

Why Choose This Template?

-

User-Friendly & Intuitive

Whether you're using Excel or Google Sheets, this template is designed to be simple and easy to use, with clear instructions for getting started. -

Works Across Devices

Access your budget from anywhere and on any device, whether you're at home on your computer or on the go with your mobile device. -

Perfect for Both Personal & Business Use

Whether you need to manage your personal finances or streamline your business expenses, this template can handle both with ease.

WHAT’S INCLUDED?

- Step-by-step instructions

- 4 Templates of Spreadsheets

- Sample Google Sheet with Mock Data

- Blank Google Sheet

- Sample Excel with Mock Data

- Blank Excel

- Editable in Google Sheets and Microsoft Excel

- Compatible with MAC, PC, Phones, or Tablets

FEATURES & LIMITATIONS

- Automated Calculations: All totals, charts, and summaries update automatically when data is entered. No manual math required.

- Currency Customization: For all budget and finance-related templates, you can easily change the currency symbol (USD, EUR, GBP, etc.) in just a few clicks.

- Protected Formulas: Certain cells and tabs are locked to prevent accidental deletion of complex formulas, ensuring your template works perfectly. However, no passwords are required—you can easily unlock the sheets if you wish to customize the structure.

- Language: This template is provided in English

- No Macros: We use advanced formulas instead of VBA macros, making the files safer and more compatible across different devices.

HOW IT WORKS & REQUIREMENTS

SYSTEM REQUIREMENTS:

To ensure all features and automated functions work correctly, you will need:

- Microsoft Excel: A subscription to Microsoft 365 (formerly Office 365) is strictly required. Older versions (Excel 2019 or earlier) may not support all formulas.

- Google Sheets: A free Google Account if you prefer using the web-based version.

- Device: A desktop or laptop is highly recommended for the best experience. Mobile devices may have limited editing capabilities.

HOW IT WORKS:

- Purchase and download your files instantly.

- Open the PDF file to access your unique Google Sheets link.

- Open the Excel file directly if using Microsoft 365.

- Follow the setup instructions inside and start planning!

IMPORTANT TO KNOW:

- Compatibility: This template is exclusively designed for Microsoft 365 and Google Sheets. It is not compatible with Numbers (Apple), LibreOffice, or OpenOffice.

- Refund Policy: Due to the instant nature of digital downloads, no refunds or exchanges can be given once the files are downloaded. Please verify your software compatibility before purchase.

- Personal Use Only: Your purchase grants you a single-user license. Re-selling, sharing, or distributing this template in any form is strictly prohibited and protected by copyright law.

DISPLAY & COLOR DISCLAIMER: The visual appearance of the spreadsheet may vary slightly depending on your screen resolution, color settings, and device hardware. For the best experience, we recommend using a desktop or laptop.

NEED HELP? If you have any questions, feel free to reach out to us at spreadsheetshub.office@gmail.com or info@spreadsheetshub.com. You can also contact us on WhatsApp for assistance.