70/15/10/5 Budget Spreadsheet Template | Excel & Google Sheets

Buy 2+ items → Extra 25% OFF on your total

⭐ JOIN & SAVE

Grab this template and 4 more with

SpreadsheetsHub Membership

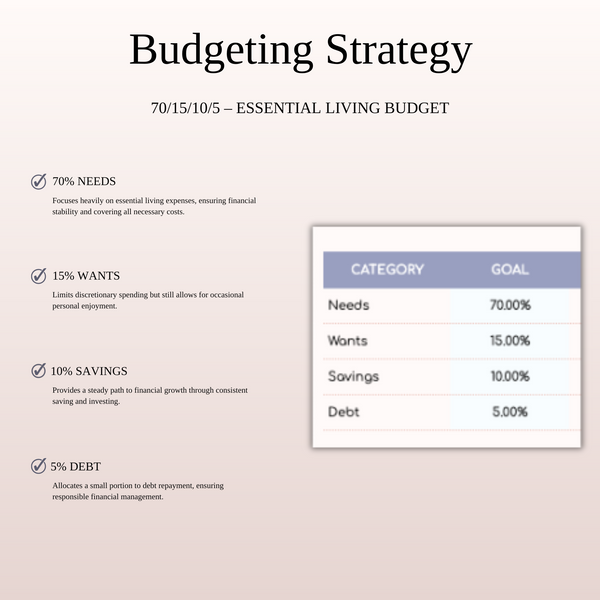

70/15/10/5 – Essential Living Budget (Prioritizing necessities while managing finances)

The 70/15/10/5 Essential Living Budget is a financial planning method designed for those who want to focus on essential living costs while still managing savings and debt. This budget is ideal for individuals or families looking to ensure stability, prioritize necessities, and maintain consistent growth, all while keeping discretionary spending and debt payments in check.

How the 70/15/10/5 Essential Living Budget Works

This budget template divides your income into four main categories, helping you focus on financial stability and manage your money wisely:

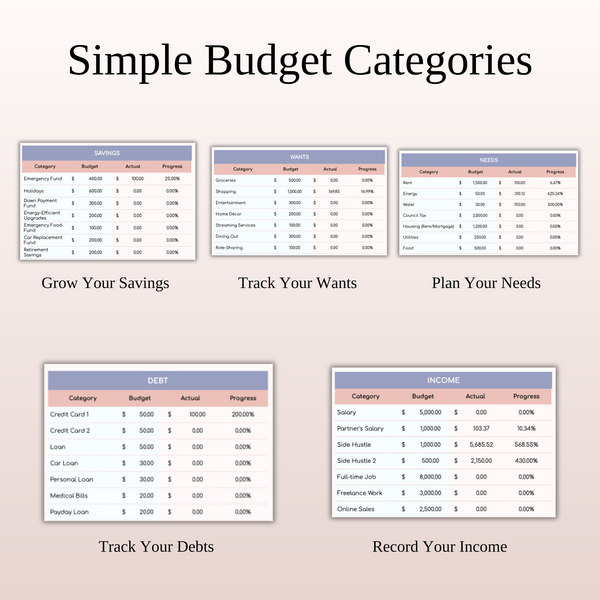

- 70% NEEDS – This category is focused on the essential costs of life that you cannot live without. It includes expenses like rent, utilities, groceries, transportation, and healthcare. By allocating the largest portion of your budget to your needs, you ensure that survival and stability come first.

- 15% WANTS – With limited discretionary spending, this part of the budget allows for some enjoyment, but with a careful eye on your overall finances. This includes entertainment, dining out, hobbies, and other non-essential purchases.

- 10% SAVINGS – Even when focusing on necessities, it’s important to save for the future. The 10% allocated for savings ensures that you continue to grow your wealth, whether through retirement contributions, investments, or emergency funds.

- 5% DEBT – Keeping your debt under control is critical. This portion of your budget helps you make regular debt payments, whether it’s for credit cards, loans, or other financial obligations, ensuring that you reduce liabilities over time.

Benefits of the 70/15/10/5 Essential Living Budget

- Focus on Stability: By allocating the majority of your income to needs, you guarantee that you have the essentials covered. This approach prioritizes your survival and financial stability above all else.

- Smart Debt Management: The 5% allocated for debt repayment allows you to stay on top of your obligations without sacrificing other areas of your life. It helps you reduce outstanding debts steadily, without overwhelming your finances.

- Consistent Financial Growth: Saving 10% of your income is an important step toward building a secure future. Whether you’re preparing for retirement, an emergency fund, or future investments, the Essential Living Budget ensures consistent financial growth.

- Balance and Control: While the 70% allocation goes to essentials, the remaining 30% lets you maintain a balance of fun and financial responsibility. The budget structure gives you flexibility for lifestyle spending while keeping your priorities in check.

Who Should Use the 70/15/10/5 Essential Living Budget?

This budgeting plan is perfect for anyone who wants to prioritize necessities while staying on top of savings and debt. It is especially suitable for:

- Individuals in Transition: If you’re in a new phase of life, such as starting a new job, transitioning to a single income, or managing financial responsibilities as a student, this budget allows you to focus on stability while ensuring long-term growth.

- Families on a Tight Budget: For households with limited income, this budget helps allocate funds wisely to ensure the family’s needs are covered while managing any financial obligations. It also keeps savings on track for future security.

- Debt-Sensitive Individuals: If you have debts to pay off but still want to save and enjoy life, the 70/15/10/5 Essential Living Budget offers a manageable way to balance debt repayment with other important financial goals.

Why Choose the 70/15/10/5 Essential Living Budget?

- Realistic Approach: The 70/15/10/5 plan offers a balanced and realistic way of managing your finances, focusing heavily on the essentials while also allowing room for future financial growth.

- Simplicity and Clarity: This easy-to-follow budgeting method helps you keep track of your expenses without overwhelming complexity. The categories are straightforward, making it simple to follow and maintain.

- Long-Term Financial Health: By prioritizing both savings and debt management, this plan helps you build a stable and healthy financial future, all while ensuring that your current needs and lifestyle are satisfied.

- Customizable for Your Lifestyle: Whether you're working with a small budget or looking to improve financial control, the 70/15/10/5 Essential Living Budget provides flexibility to adapt to your specific financial situation.

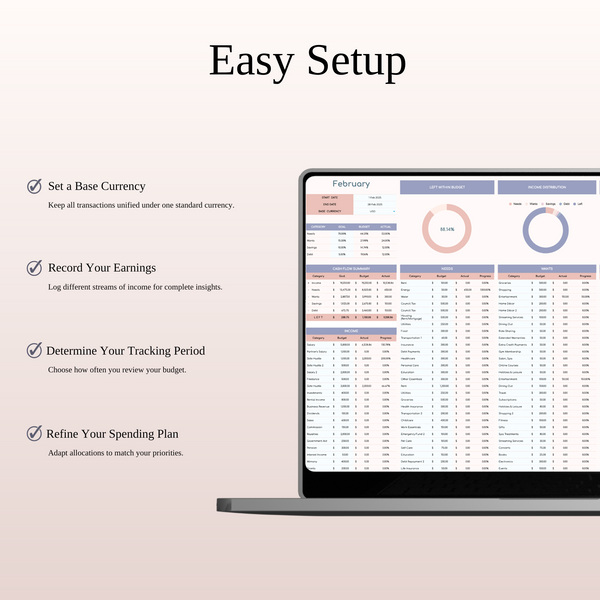

How to Get Started with the 70/15/10/5 Budget

The 70/15/10/5 Essential Living Budget is available as an easy-to-use template in Google Sheets and Excel, allowing you to track your spending and savings effortlessly. You can customize it to fit your personal or family needs, making it an ideal tool for anyone looking to take control of their finances with a focus on essentials and long-term financial health.

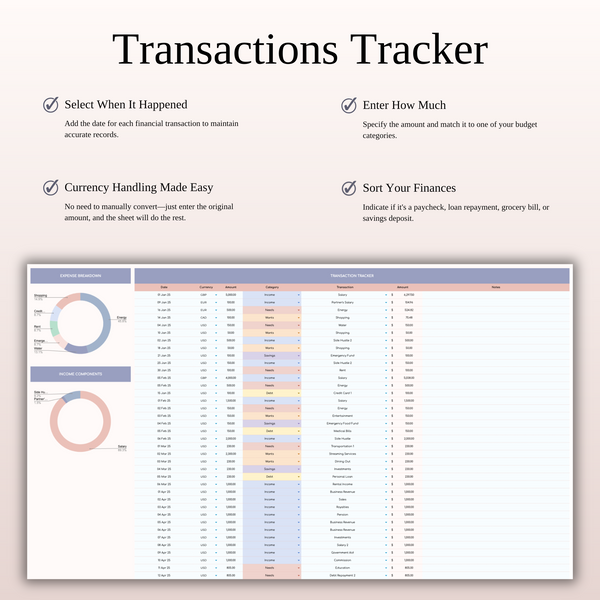

WHAT’S INCLUDED?

- Step-by-step instructions

- 4 Templates of Spreadsheets

- Sample Google Sheet with Mock Data

- Blank Google Sheet

- Sample Excel with Mock Data

- Blank Excel

- Editable in Google Sheets and Microsoft Excel

- Compatible with MAC, PC, Phones, or Tablets

FEATURES & LIMITATIONS

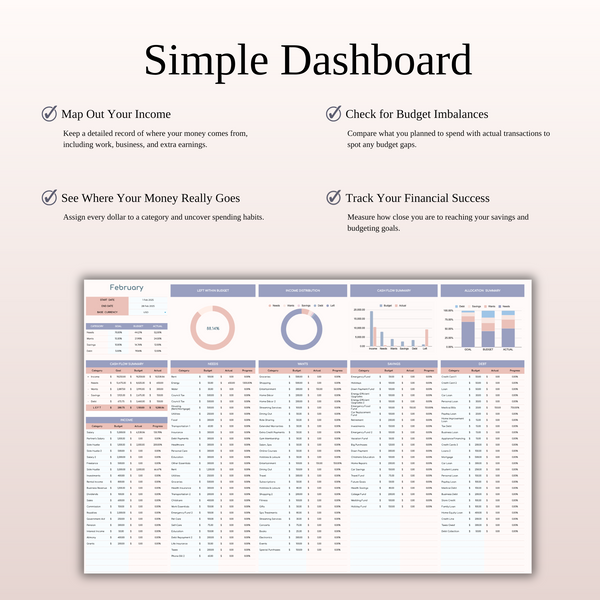

- Automated Calculations: All totals, charts, and summaries update automatically when data is entered. No manual math required.

- Currency Customization: For all budget and finance-related templates, you can easily change the currency symbol (USD, EUR, GBP, etc.) in just a few clicks.

- Protected Formulas: Certain cells and tabs are locked to prevent accidental deletion of complex formulas, ensuring your template works perfectly. However, no passwords are required—you can easily unlock the sheets if you wish to customize the structure.

- Language: This template is provided in English

- No Macros: We use advanced formulas instead of VBA macros, making the files safer and more compatible across different devices.

HOW IT WORKS & REQUIREMENTS

SYSTEM REQUIREMENTS:

To ensure all features and automated functions work correctly, you will need:

- Microsoft Excel: A subscription to Microsoft 365 (formerly Office 365) is strictly required. Older versions (Excel 2019 or earlier) may not support all formulas.

- Google Sheets: A free Google Account if you prefer using the web-based version.

- Device: A desktop or laptop is highly recommended for the best experience. Mobile devices may have limited editing capabilities.

HOW IT WORKS:

- Purchase and download your files instantly.

- Open the PDF file to access your unique Google Sheets link.

- Open the Excel file directly if using Microsoft 365.

- Follow the setup instructions inside and start planning!

IMPORTANT TO KNOW:

- Compatibility: This template is exclusively designed for Microsoft 365 and Google Sheets. It is not compatible with Numbers (Apple), LibreOffice, or OpenOffice.

- Refund Policy: Due to the instant nature of digital downloads, no refunds or exchanges can be given once the files are downloaded. Please verify your software compatibility before purchase.

- Personal Use Only: Your purchase grants you a single-user license. Re-selling, sharing, or distributing this template in any form is strictly prohibited and protected by copyright law.

DISPLAY & COLOR DISCLAIMER: The visual appearance of the spreadsheet may vary slightly depending on your screen resolution, color settings, and device hardware. For the best experience, we recommend using a desktop or laptop.

NEED HELP? If you have any questions, feel free to reach out to us at spreadsheetshub.office@gmail.com or info@spreadsheetshub.com. You can also contact us on WhatsApp for assistance.