45/30/20/5 Budget Spreadsheet Template | Excel & Google Sheets

Buy 2+ items → Extra 25% OFF on your total

⭐ JOIN & SAVE

Grab this template and 4 more with

SpreadsheetsHub Membership

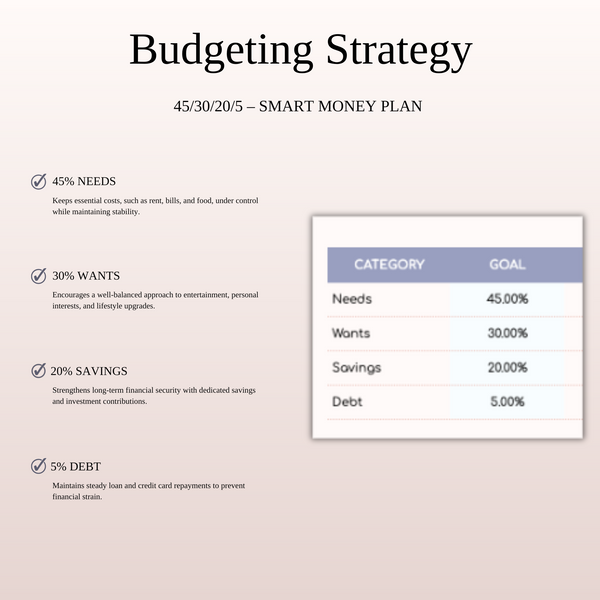

45/30/20/5 – Smart Money Plan (Balancing essential costs, fun, and financial health)

The 45/30/20/5 Smart Money Plan is a practical and efficient financial budgeting method designed to balance essential costs, personal enjoyment, savings for the future, and debt management. This plan allows individuals to maintain a healthy financial balance while still enjoying their lifestyle and planning for long-term security. Perfect for those who want a clear structure for managing their finances without sacrificing enjoyment or neglecting savings.

How the 45/30/20/5 Smart Money Plan Works

This budget splits your income into four essential categories, each representing a crucial part of a balanced financial life:

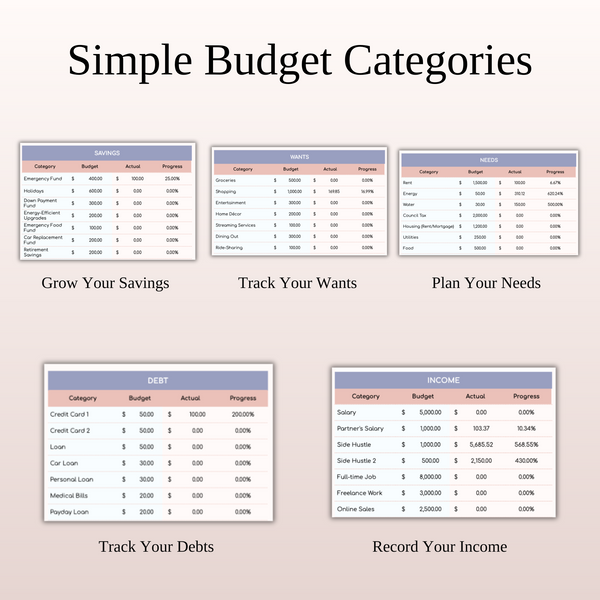

- 45% NEEDS – Covering essential costs like rent, utilities, groceries, healthcare, and transportation.

- 30% WANTS – Allowing room for lifestyle enjoyment like dining out, entertainment, hobbies, and travel.

- 20% SAVINGS – Prioritizing long-term financial security, including investments, retirement savings, and emergency funds.

- 5% DEBT – Allocating a portion to manage and pay off outstanding debt, such as loans or credit card bills.

Key Benefits of the Smart Money Plan

- Financial Balance: This plan ensures that essential costs are covered while also giving you the flexibility to enjoy life without guilt. It keeps you financially healthy and stress-free.

- Long-Term Security: By putting 20% of your income into savings, you’re building wealth for the future. The Smart Money Plan helps you stay focused on both short-term enjoyment and long-term financial goals.

- Debt Management: The 5% allocation for debt ensures that you’re consistently making progress on any outstanding obligations, reducing financial stress over time.

- Adaptability: The Smart Money Plan can be customized to fit your individual needs, whether you’re looking to adjust for more savings or allocate slightly more to entertainment.

Why Choose the 45/30/20/5 Smart Money Plan?

- Clear Structure: With a clear and simple allocation, you’ll always know exactly where your money is going, helping you stay organized and avoid financial confusion.

- Comprehensive Coverage: It covers all aspects of your finances—essentials, lifestyle, savings, and debt—ensuring that you stay on track with your financial goals.

- Financial Freedom: By focusing on savings and debt, the Smart Money Plan offers a path to financial independence while allowing room for personal enjoyment. You don’t have to choose between your financial future and your present-day pleasures.

- Easy to Use: Whether you use Google Sheets or Excel, this budget template is designed for ease of use, helping you track your spending effortlessly and stay on top of your finances.

Who Is the 45/30/20/5 Smart Money Plan For?

This budgeting method is perfect for anyone who wants a structured approach to managing their finances. Whether you’re just starting out in your career, planning for a major life change, or simply looking to get better control over your budget, the Smart Money Plan offers a solution that works for everyone.

- Young Professionals: Focus on building savings, paying off debt, and still enjoying your youth.

- Families: Cover the essential expenses of daily life, while saving for future needs and maintaining financial health.

- Freelancers & Entrepreneurs: With fluctuating income, this plan helps balance needs and wants while prioritizing savings for business and personal growth.

Achieve Financial Balance with the Smart Money Plan

The 45/30/20/5 Smart Money Plan is the ideal solution for anyone seeking to balance essential expenses, lifestyle, savings, and debt management. By allocating your income wisely across these four key categories, you’ll create a financial strategy that supports both your present and future needs. Get started today with a Google Sheets or Excel template, and take control of your financial destiny.

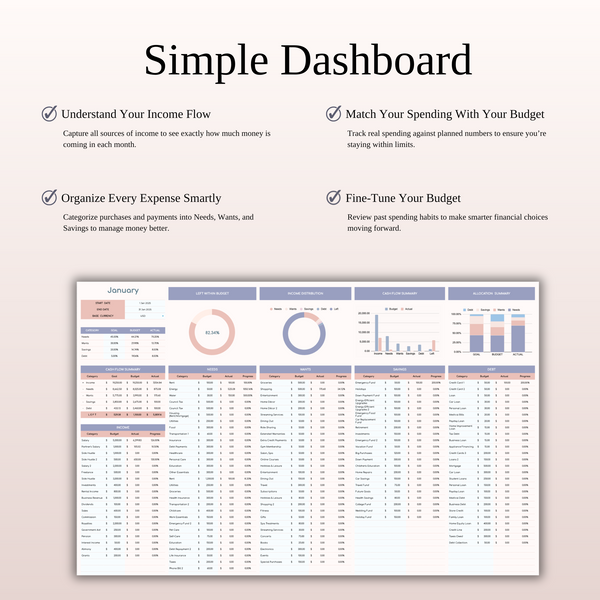

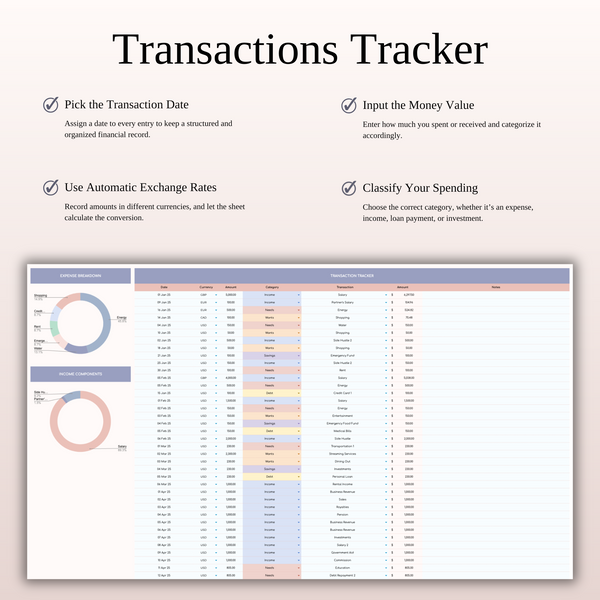

WHAT’S INCLUDED?

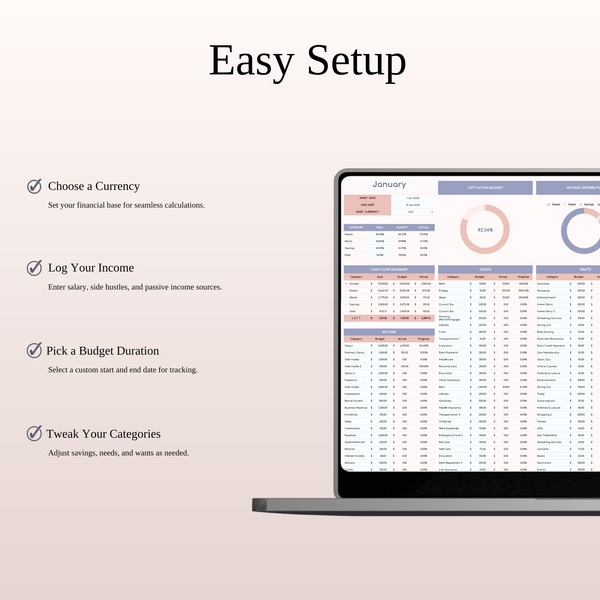

- Step-by-step instructions

- 4 Templates of Spreadsheets

- Sample Google Sheet with Mock Data

- Blank Google Sheet

- Sample Excel with Mock Data

- Blank Excel

- Editable in Google Sheets and Microsoft Excel

- Compatible with MAC, PC, Phones, or Tablets

FEATURES & LIMITATIONS

- Automated Calculations: All totals, charts, and summaries update automatically when data is entered. No manual math required.

- Currency Customization: For all budget and finance-related templates, you can easily change the currency symbol (USD, EUR, GBP, etc.) in just a few clicks.

- Protected Formulas: Certain cells and tabs are locked to prevent accidental deletion of complex formulas, ensuring your template works perfectly. However, no passwords are required—you can easily unlock the sheets if you wish to customize the structure.

- Language: This template is provided in English

- No Macros: We use advanced formulas instead of VBA macros, making the files safer and more compatible across different devices.

HOW IT WORKS & REQUIREMENTS

SYSTEM REQUIREMENTS:

To ensure all features and automated functions work correctly, you will need:

- Microsoft Excel: A subscription to Microsoft 365 (formerly Office 365) is strictly required. Older versions (Excel 2019 or earlier) may not support all formulas.

- Google Sheets: A free Google Account if you prefer using the web-based version.

- Device: A desktop or laptop is highly recommended for the best experience. Mobile devices may have limited editing capabilities.

HOW IT WORKS:

- Purchase and download your files instantly.

- Open the PDF file to access your unique Google Sheets link.

- Open the Excel file directly if using Microsoft 365.

- Follow the setup instructions inside and start planning!

IMPORTANT TO KNOW:

- Compatibility: This template is exclusively designed for Microsoft 365 and Google Sheets. It is not compatible with Numbers (Apple), LibreOffice, or OpenOffice.

- Refund Policy: Due to the instant nature of digital downloads, no refunds or exchanges can be given once the files are downloaded. Please verify your software compatibility before purchase.

- Personal Use Only: Your purchase grants you a single-user license. Re-selling, sharing, or distributing this template in any form is strictly prohibited and protected by copyright law.

DISPLAY & COLOR DISCLAIMER: The visual appearance of the spreadsheet may vary slightly depending on your screen resolution, color settings, and device hardware. For the best experience, we recommend using a desktop or laptop.

NEED HELP? If you have any questions, feel free to reach out to us at spreadsheetshub.office@gmail.com or info@spreadsheetshub.com. You can also contact us on WhatsApp for assistance.